Table of Contents

Forex Swap

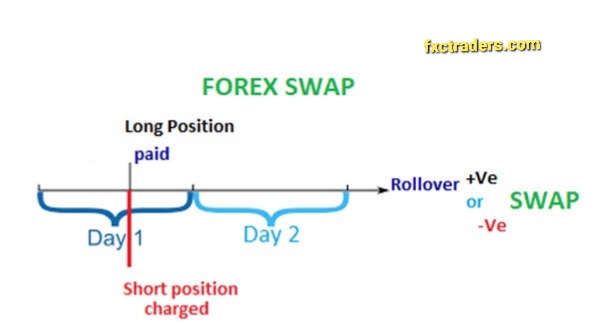

In forex trading, a forex swap is a financial transaction in which one party purchases an amount of another currency and then sells that same amount back to the other party in return for the original currency. In finance, a forex swap is a simultaneous sale and purchase of identical amounts of one financial instrument (usually the foreign currency) at two different value dates with both transactions occurring at two different dates. A forex swap trading strategy would therefore be to buy at a lower price and sell back at a higher price. A forex swap can be used for any financial instrument. However, the most common are forex swaps for foreign currencies. There are various types of forex swaps. This includes interest rate swaps, spot forex swaps, and future forex swaps.

| Broker | Info | Bonus | Open Account |

|---|---|---|---|

|

Regulation: CySEC, FCA, FSC Leverage: 30:1 Retail & Up to 1000:1 Professional Demo Account: Yes Min Deposit: $10 |

$250 | Visit Broker Read Review |

Basics Of Forex Swaps

Forex exchange rates are updated frequently and are available to all investors through brokers. This is the reason why fx swap are traded on major exchanges. There are also many online forex trading companies. These services cater specifically to traders who want to trade in the forex market. But who are unable to attend live markets due to various factors. This factors such as geographical and time constraints, which make trading online preferable. Follow this forex trading challenges.

Types Of Forex Swaps

One of the most popular types of fx swap is the spot exchange rate; this involves the selling and buying of a specific quantity of the foreign currency.

Spot forex swaps are usually entered on a short term basis, typically no more than a month. In forex trading, the two currencies traded are usually those of the countries in which the trader’s company is based. For example, if a trader is trading the euro/dollar pair, and he wants to trade the Japanese yen, he would enter the transaction on the EUR/JPY spot. It is important to note that although this type of forex swap provides the trader with better opportunities for profits. There is also a high risk of losses when you compare the two currency pairs.

Benefits Of Forex Swap

1: This form of fx swap are entered on the basis of what is known as “click positions”. This means that the forex trader will only be purchasing and selling particular currency pairs; hence, these transactions are known as “click positions”. Because the trader will be selling a currency pair at one price and buying another at a different price, he will make a profit by the difference between the two prices. These clicks are not subject to the customary margin requirements that long position transactions are. The broker collects his fee from the selling price and the buying price.

2: Another benefit that comes with the sale of forex swaps is hedging purposes. When these transactions occur. The forex trader will be able to hedge against the fluctuations of certain currency pairs by the sale or purchase of another currency. This way, they are able to protect themselves from the fluctuating values of their positions. They can use this method by making purchases when the value of one currency is increasing and selling them when the value of the other is decreasing. As the value of the other currency pair declines, the forex trader’s position will be protected. In the same way, the position of the seller will be safe, if the value of the currency being sold increases.

Conclusion

With forex swaps, the currency conversion is more reliable than the conventional methods of currency conversion. However, it’s important to note that the performance of this method does not depend entirely on the market. The value of the currencies does affect the results of the trades. Also, since the values of the currencies change frequently, the trader may end up losing money in the process. This is why it is important to consider the risks involve with fx swap when one decides to enter into the world of forex trading.

If you want to trade forex, you should consider using this broker here. However there are other forex trading strategies like scalping. Learn to trade successfully with this trading strategies.

Risk Disclosur

Finally, Forex and CFD are complex instruments, retail investor accounts lose money when trading CFDs. Don’t Invest all you have, and please consider if you can afford to take the high risk of losing money rapidly due to leverage.

65% of of investors accounts lose their money when trading in the forex market, therefore trade with caution.

More-so we would like to let you know that Our company makes money as affiliate. Therefore each time you sign up we receive commissions.

However it doesn’t affect your investment. We would appreciate if you use our company link for all your investment. See our 9 best forex brokers (2020)

See why most forex traders fail.