Table of Contents

Tickmill Review 2024: Spreads, account types, Fees and Platform Comparison

In the world of online trading, choosing the right broker is crucial. One such broker that has been gaining popularity among traders is Tickmill. In this comprehensive tickmill review, we will delve into everything you need to know about Tickmill – from its spreads and fees to platform comparison.

Tickmill Review 2024

Tickmill is a renowned broker in the financial market with an impressive TU Overall Score of 9.15 out of 10. The company caters to both professional traders and novices alike, offering optimal conditions for robotic trading as well as short-term strategies.

Tickmill takes pride in its innovative approach towards providing brokerage services. The company’s commitment to innovation has earned it numerous awards including Best Forex Spreads and Best Forex Trading Experience in 2022.

The Tickmill Group comprises several entities regulated by different authorities worldwide:

- Tickmill Europe Ltd (CySEC)

- Tickmill Ltd (FSA)

- Tickmill UK Ltd (FCA)

- Tickmill Asia Ltd (Labuan FSA)

- Tickmill South Africa Pty Ltd (FSCA)

Before registering with them, ensure you understand which group’s company you are signing up with because trading conditions may vary accordingly.

Tickmill Regulation and Safety

When it comes to regulation and safety, TickMill scores a commendable 8.92 out of 10. This score reflects the level of trust instilled by the licenses held by the company’s entities across various jurisdictions worldwide.

The higher the level of license a company holds, the higher its score on this parameter becomes. For instance:

- Level 1 jurisdictions like USA(CFTC), Switzerland(FINMA), UK(FCA) etc. offer a high level of trust.

- Level 2 jurisdictions like Cyprus(CySEC), South Africa(FSCA), China(CBRC) etc. offer a medium level of trust.

- Level 3 jurisdictions like Belize(FSC), British Virgin Islands(FSC), Mauritius(FSC) etc. offer a low level of trust.

Being regulated by multiple tier-1 regulators like FCA, CySEC, FSCA etc. demonstrates Tickmill’s commitment to safety and compliance. This ensures client funds and data are well-protected in segregated accounts.

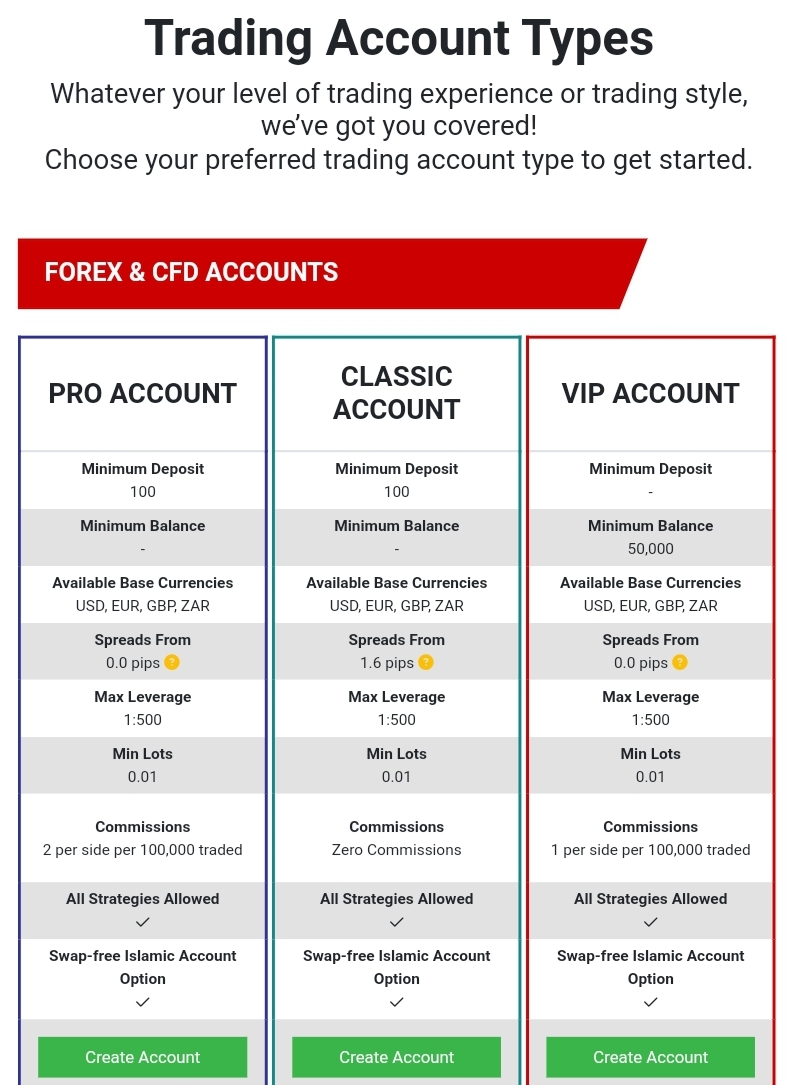

Tickmill Account Types

Tickmill offers three types of accounts to cater to the diverse needs of its clients:

- Classic Account: This is a commission-free account where traders only pay the bid/ask spread.

- Pro Account: This account charges low per-trade commissions on top of low-cost spreads.

- VIP Account: With a minimum balance requirement of $50,000, this account offers even lower commissions and competitive spreads.

Each tickmill account types comes with its own set of features and benefits, so traders can choose one that best suits their trading style and financial goals.

For example, the VIP account offers additional benefits like dedicated account manager, faster withdrawals, and access to exclusive events. So it’s ideal for professional traders with higher trading volumes.

On the other hand, novice traders can opt for the Classic account to avoid commissions while getting familiar with the markets.

Tickmill Spreads and Fees

When it comes to spreads and fees, Tick mill scores an impressive 8.48 out of 10. The company provides minimal spreads which are appreciated by scalpers and traders who use EAs (Expert Advisors).

However, it’s important to note that specific fees such as inactivity fee are taken into consideration when calculating the final score for fees.

Here’s a quick overview of Tickmill’s fee structure:

Classic Account

- Tight spreads from 0.0 pips

- No commissions

- Inactivity fee charged after 6 months of no trading activity

Pro Account

- Ultra-tight spreads from 0.0 pips

- $3.5 per lot commission fee

- Swap fees for holding positions overnight

VIP Account

- Zero spread account

- $2 per lot commission

- Lower swap fees

- Dedicated account manager

So based on your trading style and capital, you can choose an account that provides the optimal fee structure for your needs.

Tickmill Trading Platforms

Tick mill offers industry-leading trading platforms like MetaTrader 4 & 5 which are popular among traders worldwide. Let’s take a look at their key features and tools:

Tick mill offers industry-leading trading platforms like MetaTrader 4 & 5 which are popular among traders worldwide. Let’s take a look at their key features and tools:

MT4 Platform

MetaTrader 4 (MT4) is one of the most popular trading platforms among forex traders due to its user-friendly interface and comprehensive features. With MT4, you can conduct advanced technical analysis using over 30 built-in indicators and graphical objects.

Some of its standout features include:

- Advanced charting package with multiple timeframe analysis

- Automated trading through Expert Advisors (EAs)

- Custom indicators and trading scripts

- One-click trading from charts

- Trading signals and copy trading

- Backtesting trading strategies

Overall, MT4 provides everything you need for seamless trading experience.

MT5 Platform

MetaTrader 5 (MT5) is an upgraded version offering additional features such as more timeframes, economic calendar integration, depth-of-market view, more pending order types etc., making it ideal for professional traders.

Some unique benefits of MT5:

- Support for trading stocks, futures and options

- Built-in fundamental analysis tools

- Market depth information

- 21 different order types

- Copy trading investment programs

So if you trade multiple markets or use advanced trading techniques, MT5 is a great choice.

Both platforms provide automated trading capabilities through Expert Advisors (EAs) and allow backtesting of strategies.

Tickmill Mobile Trading

For traders who prefer to trade on the go, Tickmill offers mobile trading options through MT4 and MT5 mobile apps. These apps are available for both iOS and Android devices, providing full access to your account and trading features anytime, anywhere.

The mobile apps allow you to:

- Monitor price charts and market movements

- Open and manage trades

- Conduct technical analysis adding indicators

- Customize layouts and widgets

- Get price alerts and notifications

With a neatly organized interface, you can easily switch between multiple trading instruments on these apps.

Customer Support

Tickmill’s customer support scores a 9.10 out of 10 based on the number of available communication channels and their efficiency in handling requests. They offer multiple channels including live chat, email, phone support etc., ensuring quick response times and comprehensive assistance.

Some of the support highlights include:

- 24/5 dedicated support via live chat, email and phone

- Localized support in over 15 languages

- Knowledgeable agents who are well-versed in trading

- Swift dispute resolution

- Active user community on social media

They also provide an extensive FAQ section covering various trading and account-related queries. So you are assured prompt support whenever required.

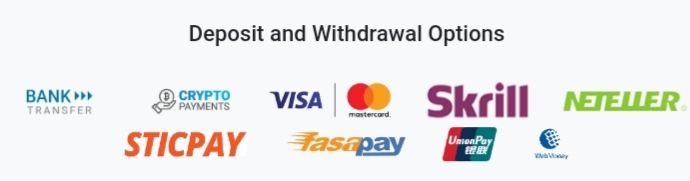

Funding and Withdrawals

Tickmill provides several methods for depositing funds into your trading account such as bank wire transfer, credit/debit cards, e-wallets like Skrill & Neteller etc.

Tickmill provides several methods for depositing funds into your trading account such as bank wire transfer, credit/debit cards, e-wallets like Skrill & Neteller etc.

The withdrawal process is also straightforward with most requests processed within one business day.

Some key points about Tickmill’s deposit/withdrawal process:

- No deposit fees charged

- Numerous payment options available

- Industry-standard security protocols followed

- Dedicated customer support for payments

- Most withdrawals processed under 24 hours

So you can conveniently fund your account and access your profits without any hassles.

Final Verdict

With its competitive spreads, diverse account types, robust platforms (both desktop & mobile), efficient customer support and transparent fee structure; Tickmill has proven itself as a reliable broker in the forex market.

However, it’s always recommended to do your own research before choosing any broker.

Whether you’re a novice trader or an experienced professional looking for better trading conditions – Tickmill might be worth considering!

FAQs

Is Tickmill regulated and safe?

Yes, Tickmill is regulated by top-tier authorities like the UK’s FCA, Cyprus’ CySEC and Seychelles’ FSA. It offers segregated client funds, secure data encryption and other safety measures.

What account types does Tickmill provide?

Tickmill broker provides Classic, Pro and VIP accounts – each catering to traders with different needs and experience levels. The VIP account has the lowest spreads & commissions but requires a $50,000 minimum deposit.

What trading platforms does Tickmill offer?

Tickmill offers the globally popular MetaTrader 4 and MetaTrader 5 platforms for desktop and mobile trading on iOS and Android devices. Both platforms support advanced trading features and automated bots.

How are Tickmill’s spreads and commissions?

In the process of our Tickmill Review, we noticed that they offers ultra-competitive spreads from 0 pips along with low commission charges starting from $2 per lot. However this pricing can benefit high-frequency traders and scalpers.

Does Tickmill accept US clients?

Unfortunately, Tickmill does not accept clients from the United States due to strict US regulations. Only non-US clients can open an account with Tickmill internationally.

Tickmill Review 2024 Conclusion

I hope this detailed tickmill review has covered everything you wanted to know about trading with Tickmill. From regulation and safety to fees, platforms and account types – Tickmill checks all the boxes of a quality broker.

Therefore, While the final choice depends on your individual trading requirements – do consider opening a risk-free demo account with Tickmill broker, test their services firsthand. Compare broker with binary.com.