Table of Contents

Forex position size best practices, size meaning and definition.

Forex Position Sizing Strategies

In recent times there has been an increased interest in Forex positioning and the strategies associated with it. With ever increasing leverage and risk; Some people wonder how they can profit from Forex trading and position sizing strategies without risking too much of their own money. To answer this question we need to first of all understand what position sizing is all about. It is essentially the usage of forex strategies which are good for the individual trader in order to profit from small price movements in the market.

What is the Best Forex Position Size Strategy?

As with anything else in life, you get what you pay for. The best Forex position sizing strategies will be the ones that allow the most amount of profit whilst keeping a reasonable account balance. As the account balance reduces and fewer trades are run. The less risk is incurred and hence better performance is obtained.

Position Size Strategies

There are three main areas in which position sizing strategies can be implemented. These are:

- Scalping Forex,

- Stochastic Forex and

- Relative Strength Trading.

Each of these is for a particular trader and thus will require different training and approach methods in order to be successful. Some traders may find scalping forex easier than others. And therefore it is the area that should be examined first when you are setting out to develop your trading plan. This is because as the price moves rapidly up or down; You will only be able to sell short positions if you exit your position at the right time.

If your main purpose is to enter and exit positions quickly and profit from small changes in price, then you will benefit more from a scalping strategy.

In this case you would be best suited to a fixed risk position sizing strategy, whereby your trading size is closely controlled by your account balance. With a fixed risk position sizing strategy, you are not concerned about price movements. The size of your position will not change due to market conditions. And no matter how volatile the market is, you will always be able to sell short at a profit. This type of strategy has the potential to minimize the effect of market risk by limiting the size of trades and maintains a consistent overall size of account.

Relative Strength Trading And Scalping

The relative strength trading relates to a scalping strategy based on trends in a particular currency pair. The idea here is that by understanding the economic conditions of a currency pair over a longer period of time. You can make a more informed guess about where the market may move in the near future. Because you are trading a fixed position size; This strategy does not require you to concern yourself with any market risks. However, because there is a larger potential for losses in relation to the size of your position. You must still develop a solid trading plan to ensure that unfavorable market conditions will not affect your trades heavily.

Conclusion

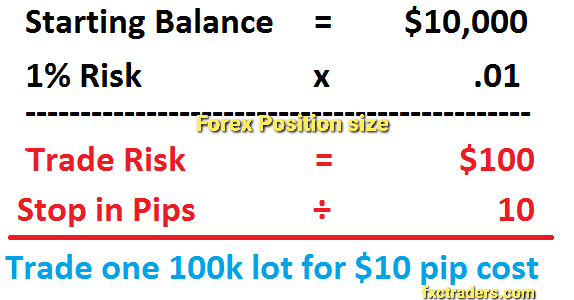

Finally, one of the simplest strategies to use when entering the foreign exchange market is to determine your position size. Your decision to determine your position size will ultimately be based on several factors. You will want to first determine how much you can afford to risk on each trade. And how big of a position you are planning to open. It also helps to determine if you plan to use stop loss order functions. Once you determine these factors, you can then place an order with a Forex broker and get start trading. Trade binary options with videforex