Table of Contents

Central Bank Reserves – A Key Consideration in the GDP Growth Report released by the Federal Reserve. How is central bank reserves related to forex and how do we use positively?.

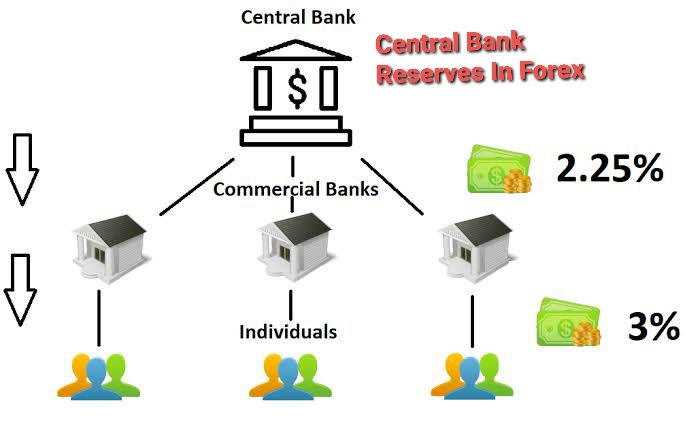

Therefore, Many people are aware of various operations and special features of central bank reserves. A few, however, are also aware of how such operations (if central bank reserves) affect forex trading. Through the first channel, primarily commercial banks that hold treasury notes and other financial obligations. However can use a variety of tools to manipulate the supply of and the exchange rates of their currencies. The second channel, less known, but nevertheless significantly influential. Pertains to central banks sometimes investing official reserves directly in bank notes. And securities of other foreign banks, and possibly other foreign currency.

Reserve Bank

A central bank that does not control currency is called a reserve bank. In such cases, the central bank compensates for its loss of purchasing power through interest income and trading revenues. The compensation is made on a monthly basis by either directly or indirectly. This is through the commercial banks that hold the bank’s assets. Through the operations described in the previous section.

A central bank may make purchases of goods and services denominated in foreign currency. However, then sells to its own official currency counterparts for immediate profits. While these operations tend to be short term in nature. They do have significant long term effects on the value of the nation’s currency, foreign exchanges, and bond prices.

Interest Rate Adjustments

Looking at the interest rate Adjustments: In the second channel, the central bank trades currency with other market participants. This is on a specific dates to adjust the rate of interest it has charged to them. Interest rate adjustments allow central banks to gain and lose interest income on the portfolios of commercial banks that they hold.

However this is depending on changes in market participants’ interest rates. On the market participants’ part, most often the banks they trade with will adjust the interest rate they charge on their ow. Example, treasuries, mortgage loans, and other assets in response to changes in the economic balance between them ir reserve balance.

| Broker | Info | Bonus | Open Account |

|---|---|---|---|

|

Regulation: Bank of Ireland, ASIC, JFSA, FSCA Leverage: 1:400 Demo Account: Yes Min Deposit: $100 |

500 | Visit Broker Read Review |

Other Goods

The third type of operations to be considered in this article is “other goods”. This term is used in an accounting language called “aggregates”. In such a situation, the central bank compensates for any direct and/or indirect expenses it incurs in its trading activities. Most central banks have reserves of some kind. But the precise composition, nature, and location of such facilities vary widely from one country to the next. Some of the most common components of reserve balances are:

Reserve Balances

In the fourth step of the analysis; We consider the factors that may affect changes in the publicly available interest rates of a nation’s currency. These include fundamental factors as well as policy issue. That will affect the balance of trade (the volume of trade carried on each unit of currency in the market). In the United States, the main drivers of currency movements are the Federal Reserve; Political developments in Washington; And changes in economic policies (such as tax increases or decreases). Other drivers of currency movements include the balance of payments; (The difference between actual foreign currency purchased and cash paid in); Economic growth, and international trade.

Fundamental analysis of currency price movements uses the information that is publicly available about central bank reserves; Commercial banks, and trade flows. They use this to determine how changes in the interest rates of a nation’s currency will affect the value of the nation’s currency in the domestic market. It also takes into consideration how foreign trade will impact the value of the dollar. Moreover you read value date details for good trading knowledge.

Conclusion

The fifth section of this report looks at what the analysis may find concerning changes in the strength of the U.S. dollar. This includes looking at what the report finds to be the impact of changes in the fundamental aspects of the economy (such as employment and inflation).

The report then goes to analyze the effects that the central bank has had on the strength of the U.S. dollar through previous interventions. Finally, the report examines what the implications will be for various scenario. That include both interest rate changes in the balances of payments with the federal reserve. This analysis offers several policy recommendations. One of which is a call for the federal reserve to begin studying the use of shadow currencies; In order to improve its effectiveness as an economic tool. Trade binary options with videforex.

Above all, check out our top forex brokers and trade in the financial market