Table of Contents

XM forex broker review

| Broker | XM Review |

|---|---|

| Company name |

Trading Point of Financial Instruments Ltd |

| Founded | 21/09/1994 |

| Country | Cyprus, Australia, UK |

| Regulated by | CySEC, FCA, ASIC |

| Bonuses | $30 non-deposit Bonus up to $5,000 (t&c apply) |

| Minimum deposit | $5 |

| Leverages | 1:30 |

| US Clients | Not accepted |

| funding methods | Credit/ Debit Card, bank wire transfer, local bank transfer, Neteller, Moneybookers Skrill, etc |

| Platform | MetaTrader 4, MetaTrader 5 |

| Dealing desk | No |

| Web based | Yes |

| Mobile trading | Yes |

| Demo account | Yes |

| Islamic account | Yes |

Follow this Quick Link Of XM Review Accordingly

XM Review

XM is a charity and thequality group as a forex broker under trading point; Providing a financial services under the regulatory body of Cyprus security and exchange commission (CYSEC), ASIC and FCA. offering a wide range of progressive features for trading Forex, Stocks CFDs, Commodities CFDs, Equity indices CFDs, Precious metals CFDs, Energies CFDs and Cryptocurrencies CFDs. This broker provide essential service to their traders with a unique features.

XM is the direct gateway between investors and the global financial markets. It ensures an online trading environment with cutting-edge functionality; With advanced platforms for trading mobility and flexible trading conditions for over 100 financial instruments. Over time, the unique things that made me to go for XM is absolute fairness and transparency in their business. They choose to provide a special service to traders coupled with bonus. We cannot doubt what an award winning broker like XM can do in your trading Carie. But before we continue with some features that even made peace army to put them first let us give some useful information instead

Features

XM is dedicated to delivering superior services in currency trading, along with CFDs, equity indices, precious metals, and energies. The feature attributes that comes in XM review uncovered some hidden reason why you should have account with them. They are…

- Well regulated by multiple regulatory body

- They give you instant trading and transaction alart just like your bank

-

25+ secure payment methods

-

16 full feature trading platforms

-

More than 30 languages supported

-

24/5 personal customer service

- no re-quotes or rejections of trading order

- offers 1:30 leverage

- Very fast execution, in less than 1 second.

- They offer 60+ currency pairs and 100+ financial instruments can be traded

- XM is good both for beginners and professionals,

- Deposit is as low as $5

- They equally offer demo accounts funded with USD100,000 virtual currency.

XM Review On Account Typs

Micro Account

- Base Currency Options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract Size

- 1 Lot = 1,000

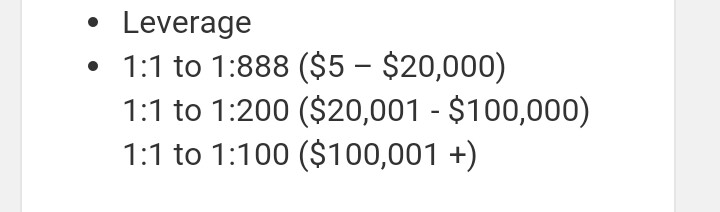

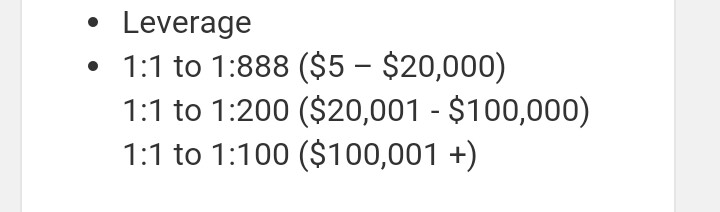

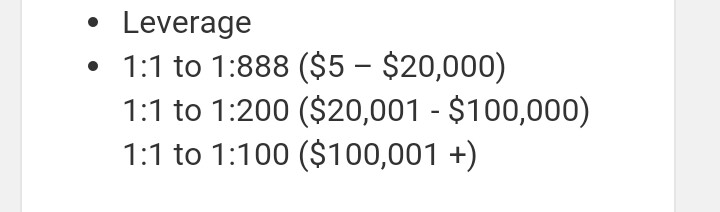

- Leverage

- Negative balance protection

- Spread on all majors

- As Low as 1 Pip

- Commission

- Maximum open/pending orders per client

- 200 Positions

- Minimum trade volume

- 0.01 Lots (MT4)

0.1 Lots (MT5)

- Lot restriction per ticket

- 100 Lots

- Trading Bonuses

- No Deposit Bonuses

- Hedging allowed

- Islamic Account

- Optional

- Minimum Deposit

- 5$

Standard Account

- Base Currency Options

- USD, EUR, GBP, JPY, CHF,

AUD, HUF, PLN, RUB, SGD, ZAR

- Contract Size

- 1 Lot = 100,000

- Leverage

- Negative balance protection

- Spread on all majors

- As Low as 1 Pip

- Commission

- Maximum open/pending orders per client

- 200 Positions

- Minimum trade volume

- 0.01 Lots

- Lot restriction per ticket

- 50 Lots

- Trading Bonuses

- No Deposit Bonuses

- Hedging allowed

- Islamic Account

- Optional

- Minimum Deposit

- 5$

XM Zero Accounts

- Base Currency Options

- USD, EUR, JPY

- Contract Size

- 1 Lot = 100,000

- Leverage

- Negative balance protection

- Spread on all majors

- As Low as 0 Pips

- Commission

- Maximum open/pending orders per client

- 200 Positions

- Minimum trade volume

- 0.01 Lots

- Lot restriction per ticket

- 50 Lots

- Trading Bonuses

- No Deposit Bonuses

- Hedging allowed

- Islamic Account

- Optional

- Minimum Deposit

- 100$

Spreads

XM spreads is 0.0 pip, see the full review here

MetaTrader 4

XM MT4 – Faster and Better

XM pioneered the offering of an MT4 platform with trading execution quality in mind. Trade on MT4 with no requotes, no rejections, and flexible leverage ranging from 1:1 – to 888:1.

- 1 Single Login Access to 8 Platforms

- Micro Lot Accounts (optional)

- Spreads as low as 0 pips

- Trade Over 1000 Instruments

MetaTrader 5

XM MT5 – 1 Platform, 7 Asset Classes

The XM MT5 offers all the pioneering features that the XM MT4 has to offer, with the addition of 300 stocks (shares) CFDs, making it the ideal multi-asset platform. Trade forex, stocks, gold, oil, equity indices and cryptocurrencies from 1 platform with no rejections, no re-quotes and flexible leverage from 1:1 to 888:1.

- 1 Single Login to 7 Platforms

- Over 80 Analytical Objects

- Market Depth of Latest Price Quotes

- Over 1000 Instruments, including Stock CFDs, Stock Indices CFDs, Forex, CFDs on Precious Metals, CFDs on Cryptocurrencies, and CFDs on Energies

This well known broker is operated by XM Global with registered address at No. 5 Cork Street, Belize City, Belize, C.A. Therefore they are good to go.

Education

Commissions & Fees

XM forex commissions and spreads varies from account, your account type determine your commission. There are three to choose from, including the commission-free Micro and Standard accounts, and the commission-based XM Zero Account.

Let’s assume that you have XM Zero account, then your average spreads on the EUR/USD will be listed as 0.1 pips (not including commission), compared to the commission-free Standard and Micro account, which had average spreads of 1.7 pips for the same pairs.

Even after including the USD $5 per side commission ($10 per Round Turn), and average spreads of 0.1 pips on the EUR/USD, the all-in cost to trade is 1.1 pips (0.1 spread + 1.0 RT commission), making the XM Zero account the firm’s most competitively priced offering.

It is worth noting that XM broker acts as the sole dealer (principal) in all trades it executes, and offers no re-quoting across all its account types in terms of the execution method as a market-maker/dealer. This allows it to offer lower spreads during certain market conditions. Accordingly, both account options are useful, depending on clients’ needs.

Conclusion on XM Review

Therefore in this occasional XM review we will conclude by saying that you are 99.9% secured trading with them. And in addition XM extensive experience combined with professional support in over 30 languages, makes XM the broker of choice for traders of all levels, anywhere. They have the expertise and the resources to help everybody. And with good training, they help traders achieve their investment goals, like only a big broker can. We advice that if you have account with other brokers, use this opportunity and see what that broker is lacking. Read iqcent review and videforex broker review

Visit broker