Using The Else Code In A Triple Exponential Moving Average Convergence Divergence Trading System.

The Triple Exponential Moving Average is a special type of MA plot; Which is based on the concept of moving averages. Traders use them all over the market because they provide them with much needed momentum. Unfortunately, they’re also very sensitive to small price changes. However which can cause them to act in the opposite direction from their trading objectives. This problem causes many traders to abandon their attempts at using the Triple Expratic Moving Average as their main indicator. Trade binary options with iqcent

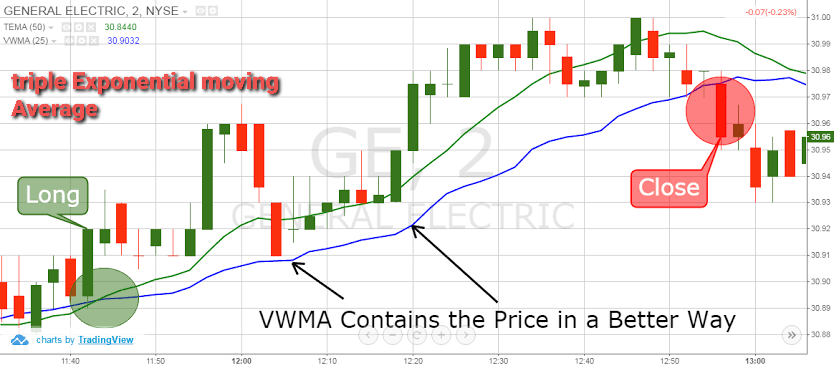

EMA Best Strategy

The Triple Expratic Moving Average is specifically designed to smooth price changes. Thus making it much easier to spot trends; Without the large lag associated with other typical moving averages (MA) used in technical analysis. It does so by taking a multiple of exponential moving averages of an underlying index and subtracting some of their delay. By doing this; It can remove much of the volatility. And thus sharpen your ability to spot a strong buying or selling opportunity.

But, because it has such low levels of delay. You can’t use the Triple Expratic Moving Average to decide when to enter and exit the market. It’s best used as part of a larger trading strategy. Example, the Moving Average Convergence Divergence (SACD). Where it can act as an independent tool or supplement to your main strategy. In either case, it is important to understand the relationship between the triple exponential MA indicator and your trading goals.

How To Use EMA

The best way to use this type of MA indicator is to think of it as being like a barometer for the underlying trend. A trend is a pattern in the stock or forex market; Which is repeated over a period of time. The trend can be either up or down, though not both. The SACD uses lagging indicators to indicate when it’s a good time to buy or sell. So if you are using a triple exponential MA indicator to analyze the market. You should also be using other lagging indicators such as the Stochastics; The MACD, and the Renko Trend Line.

There’s a traditional method of inputting the triple MA indicator into these forms. However this is called the exponential moving average convergence/divergence (EMAC). This method outputs a range which is considered to be a standard deviation. Traders often think that the higher the number; The more volatile the market. However, this is actually not the case. Due to the exponentially increasing nature of the triple MAs. It tends to cancel out any extraneous volatility due to price spikes. And thus makes it far easier to decide when to enter the market and exit.

| Broker | Info | Bonus | Open Account |

|---|---|---|---|

|

Regulation: CySEC, FCA, FSC Leverage: 30:1 Retail & Up to 1000:1 Professional Demo Account: Yes Min Deposit: $10 |

$250 | Visit Broker Read Review |

Benefits Of Triple Exponential Moving Average.

One of the benefits of using the triple exponential moving average (or EA) technique is; It helps to confirm or disprove a downtrend. Most traders only execute trades on a downtrend. This is when they believe that the price has overbought or oversold. When a market is behaving in an overbought/unsold state. This makes it harder to make accurate predictions; As prices have already dropped to their lows. But with the help of the EMA; A trader can confirm a downtrend before the market has completely entered into a downtrend.

These’s can also help confirm price targets and support levels. Since the moving average contains information about past market behavior. It can give an idea of where a trend is likely to go before it happens. Traders can then execute trades accordingly and avoid unwanted price swings when the stage of a trend is approaching its peak. Also, entering the market at a support or downtrend high will ensure that a trader has a better chance of making money. There by waiting rather than being eager to enter the market at high. This is why some traders use the else code option instead of just placing an order with the current market price. This is equally to ensure that they have a better chance of earning money from their investment. Read more guid